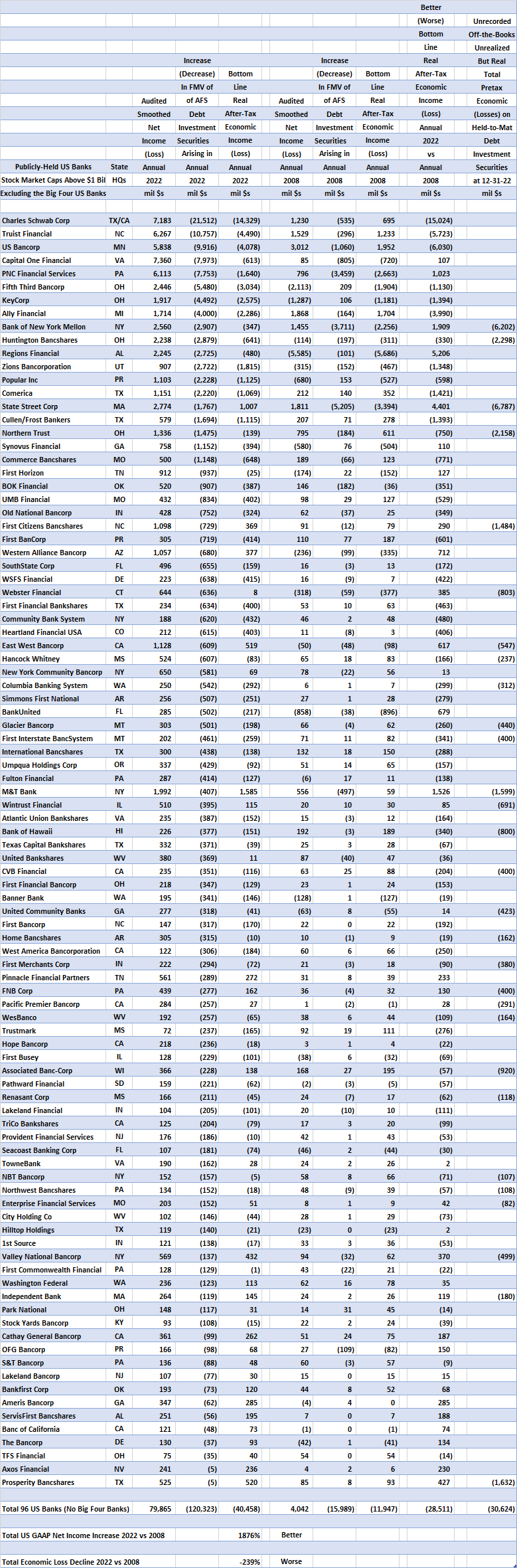

The 96 publicly-held US Banks with Stock Market Caps above $1 Bil and that disclosed its Financial Statements in both annual 2022 and in annual 2008 in its SEC filings reported Total Economic Losses of $11.947 Bil in annual 2008, the worst year for earnings for US Banks during the horrific 2008-2009 US Financial Meltdown.

So what happened in annual 2022?

Well, unfortunately these 96 US Banks posted Total Economic Losses of $40.458 Bil, predominately due to the US Fed's spastic interest rate actions which caused US Banks' Heavy Investments in Debt Securities to decline precipitously in value by $120 Bil just for their Available-For-Sale Debt Investment Securities in annual 2022.

In addition, 29 of these 96 Banks had material Unrecorded, Off-the-Books, Unrealized But Real Pretax Total Economic Losses of an additional $30.6 Bil at December 31, 2022 related to their Held-to-Maturity Debt Investment Securities.

From SEC filings, the table below shows this financial information for each of these 96 publicly-held US Banks.