From iBanknet, the table below shows the Audited Smoothed Net Income in annual 2022 and also the huge Estimated Economic Losses from the annual 2022 decline in the Fair Market Values of both their Available-For-Sale and their Held-to-Maturity Debt Investment Securities of each of the 10 largest in Total Assets US Credit Unions.

Wednesday, October 25, 2023

The 10 Largest US Credit Unions Posted Total Smoothed Net Income of $4,391 Mil in Annual 2022. But Not Included in 2022 Net Income Was Their Estimated Total Economic Losses of a Massive $8,760 Mil From the Annual 2022 Decline in the Fair Market Value of Their Available-For-Sale Debt Investment Securities. In Addition, Also Not Included in 2022 Net Income Was Their Estimated Total Economic Losses of $1,193 Mil From the Annual 2022 Decline in the Fair Market Value of Their Held-to-Maturity Debt Investment Securities.

The Big Four US Banks Posted Total Smoothed Net Income of $92.9 Bil in Annual 2022. But Not Included in 2022 Net Income Was Their After-Tax Economic Losses of $33.7 Bil From the Annual 2022 Decline in the Fair Market Value of Their Available-For-Sale Debt Investment Securities. But Much More Importantly, Also Not Included in 2022 Net Income Was Their Pre-tax Economic Losses of a Massive $201.7 Bil From the Annual 2022 Decline in the Fair Market Value of Their Held-to-Maturity Debt Investment Securities.

From their SEC filings, the table below shows the Audited Smoothed Net Income in annual 2022 and also their huge Economic Losses from the annual 2022 decline in the Fair Market Values of both their Available-For-Sale and their Held-to-Maturity Debt Investment Securities of each of what are considered to be the Big Four US Banks ..... JPMorgan Chase, Bank of America, Wells Fargo and Citigroup.

Tuesday, October 24, 2023

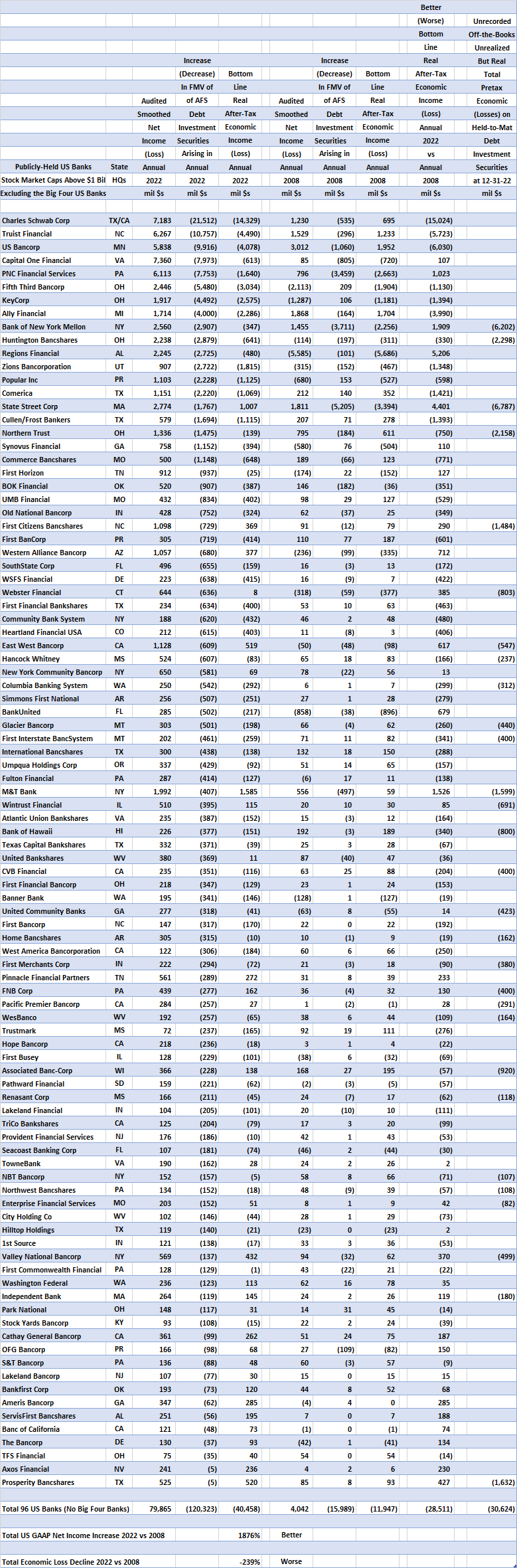

The 96 US Banks, Excluding the Big Four Banks, With Stock Market Caps Above $1 Bil Posted Total US GAAP Net Income of $79.865 Bil in Annual 2022, Up 1876% From Such Income of $4.042 Bil in the US Financial Meltdown Year of 2008. But These Same 96 US Banks Reported Total Bottom Line Economic Losses of $40.458 Bil in Annual 2022, 239% Worse Than Such Losses of $11.947 Bil in 2008. Why Such an Incredible Divergence? Well, Predominately It Was That In Annual 2022, These 96 Banks Reported a Massive $120 Bil of Economic Losses Which Bypassed US GAAP Net Losses and Instead Were Buried in Annual 2022 Other Comprehensive Losses. These $120 Bil of Economic Losses Resulted From the Annual 2022 Decline in the Market Value of Their Available-For-Sale Debt Investment Securities, Due Predominately to the US Fed's Spastic Interest Rate Increases.

The 96 publicly-held US Banks with Stock Market Caps above $1 Bil and that disclosed its Financial Statements in both annual 2022 and in annual 2008 in its SEC filings reported Total Economic Losses of $11.947 Bil in annual 2008, the worst year for earnings for US Banks during the horrific 2008-2009 US Financial Meltdown.

So what happened in annual 2022?

Well, unfortunately these 96 US Banks posted Total Economic Losses of $40.458 Bil, predominately due to the US Fed's spastic interest rate actions which caused US Banks' Heavy Investments in Debt Securities to decline precipitously in value by $120 Bil just for their Available-For-Sale Debt Investment Securities in annual 2022.

In addition, 29 of these 96 Banks had material Unrecorded, Off-the-Books, Unrealized But Real Pretax Total Economic Losses of an additional $30.6 Bil at December 31, 2022 related to their Held-to-Maturity Debt Investment Securities.

From SEC filings, the table below shows this financial information for each of these 96 publicly-held US Banks.

Monday, October 23, 2023

The 34 Smaller US Banks With Stock Market Caps Between $1 Bil and $2 Bil Posted Total Bottom Line Economic Losses of $235 Mil in the US Financial Meltdown Year of 2008. But in Annual 2022, These Same 34 Banks Posted Total Economic Losses of $1.778 Bil, an Incredible 657% Decline From That in Annual 2008. On the Other Hand, These 34 US Banks Posted Total US GAAP Net Income in Annual 2022 That Increased By an Off-the-Charts 4,192% From That in Annual 2008. Why Such an Incredible Divergence? Well, In Annual 2022, These 34 Banks Reported $7.1 Bil of Economic Losses Which Bypassed US GAAP Net Income and Instead Were Buried in 2022 Other Comprehensive Losses. These $7.1 Bil of Economic Losses Resulted From the Annual 2022 Decline in the Market Value of Their Available-For-Sale Debt Investment Securities, Due Predominately to the US Fed's Spastic Interest Rate Increases.

The 34 smaller US Banks with Stock Market Caps between $1 Bil and $2 Bil and that disclosed its Financial Statements in both annual 2022 and in annual 2008 in its SEC filings reported Total Economic Losses of $235 Mil in annual 2008, the worst year for earnings for US Banks during the horrific 2008-2009 US Financial Meltdown.

So what happened in annual 2022?

Well, unfortunately these 34 smaller US Banks posted Total Economic Losses of $1.778 Bil, predominately due to the US Fed's spastic interest rate actions which caused US Banks' Heavy Investments in Debt Securities to decline precipitously in value in annual 2022.

In addition, 7 of these 34 Banks had material Unrecorded, Off-the-Books, Unrealized But Real Pretax Total Economic Losses of an additional $1.758 Bil at December 31, 2022 related to their Held-to-Maturity Debt Investment Securities.

From SEC filings, the table below shows this financial information for each of these 34 smaller US Banks.

Friday, October 20, 2023

The 37 US and Puerto Rico Banks With Stock Market Caps Between $2 and $5 Bil Posted Total Bottom Line Economic Income of $303 Mil in the US Financial Meltdown Year of 2008. But in Annual 2022, These Same 37 Banks Posted Total Economic Losses of $3.026 Bil, an Incredible 1,099% Decline From That in Annual 2008.

The 37 US and Puerto Rico Banks with Stock Market Caps between $2 and $5 Bil and that disclosed Financial Statements in both 2022 and in 2008 reported Total Economic Income of $303 Mil in annual 2008, by far the worst year for earnings for US Banks during the 2008-2009 horrific US Financial Meltdown.

So what happened in annual 2022?

Well, unfortunately these 37 US and Puerto Rico Banks posted Total Economic Losses of $3.026 Bil, predominately due to the US Fed's spastic interest rate actions which caused US Banks' Heavy Investments in Debt Securities to decline precipitously in value in annual 2022.

In addition, 14 of these 37 Banks had material Unrecorded, Off-the-Books, Unrealized But Real Pretax Total Economic Losses of an additional $6.687 Bil at December 31, 2022 related to their Held-to-Maturity Debt Investment Securities.

From SEC filings, the table below shows this financial information for each of these 37 smaller US and Puerto Rico Banks.

Tuesday, October 17, 2023

The 12 US Banks With Stock Market Caps Between $5 and $10 Bil Posted Total Bottom Line Economic Income of $290 Mil in the US Financial Meltdown Year of 2008. But in Annual 2022, These Same 12 US Banks Posted Total Economic Losses of $8.824 Bil, a Staggering 3,143% Decline From That in Annual 2008.

The 12 US Mid-Sized Banks with Stock Market Caps between $5 and $10 Bil had Total Economic Income of $290 Mil in annual 2008, by far the worst year for earnings for US Banks during the 2008-2009 horrific US Financial Meltdown.

So what happened in annual 2022?

Well, unfortunately these 12 US Banks posted Total Economic Losses of $8.824 Bil, predominately due to the US Fed's spastic interest rate actions which caused US Banks' Heavy Investments in Debt Securities to decline precipitously in value in annual 2022.

From SEC filings, the table below shows this financial information for each of these 12 mid-sized US Banks.

Sunday, October 15, 2023

Isolating Out the Big Four US Banks, the Other 13 US Banks With Stock Market Caps Above $10 Bil posted Total Bottom Line Economic Losses of $12.3 Bil in the US Meltdown Year of 2008, But Guess What? These Total Economic Losses More Than Doubled to $26.8 Bil in Annual 2022.

Excluding the Big Four US Banks (JPMorgan Chase, Bank of America, Wells Fargo and Citigroup), the other 13 US Banks with Stock Market Caps above $10 Bil and that reported both annual 2022 and annual 2008 financial statements with the SEC incredibly saw their Total Economic Losses more than double, going from annual 2008's $12.305 Bil, the worst year for US Financial Companies during the horrific 2008-2009 US Financial Meltdown, to the US Fed-driven annual 2022's $26.830 Bil Total Economic Losses.

In addition, 6 of these 13 US Banks had material Unrecorded, Off-the-Books, Unrealized But Real Pretax Total Economic Losses of an additional $20.5 Bil at December 31, 2022 related to their Held-to-Maturity Debt Investment Securities.

From SEC filings, the table below shows this financial information for each of these 13 large US Banks.

Friday, October 13, 2023

PNC Financial Services Group's Annual 2022 Bottom-Line Net Economic Losses Were $1.640 Bil, $1,023 Better Than Its Annual 2008 Such Economic Losses of $2.663 Bil.

U. S. Bancorp's Annual 2022 Bottom-Line Net Economic Losses Were $4.078 Bil, $6.030 Worse Than Its Annual 2008 Economic Income of $1.952 Bil.

Next I will address a comparison of the Bottom-Line After-Tax Net Economic Income or Losses in annual 2022 to that in annual 2008 for the publicly-held US Regional Banks.

PepsiCo's Very High Price Increases Continue in the Third Quarter of 2023

PepsiCo just announced its Third Quarter 2023 Worldwide Pretax Income, which increased by 22% from the third quarter 2022.

US Government Bonds Declined In Value By Nearly 25% From the Summer of 2020 To Early in the Past Week

US Government Bonds have now declined in value by nearly 25% since the summer of 2020 ..... their steepest decline in US history.

Monday, March 27, 2023

The 14 TIAA-CREF Funds Reported a Total Audited Decrease in Net Assets From Operations of $10.3 Bil For the Fiscal Year Ended October 2022

From an N-CSR filing TIAA-CREF-FUNDS with the US Security & Exchange Commission, the below table shows the key operating results measure ..... The Net Decrease in Net Assets From Operations ..... for the most recent fiscal year ended October 2022 for each of the 14 Teachers Insurance and Annuity Association of America Funds (TIAA-CREF Funds).

Monday, March 20, 2023

How Even US Accounting Principles Contribute to the Current US Banking Crisis

Many years ago, the US Financial Accounting Standards Board (FASB) properly decided that many financial assets should be valued on the balance sheet at fair value.

This infuriated many financial institutions including Banks but also many non-financial institutions because they would all no longer be able to manage their quarterly reported earnings and instead report their quarterly earnings which are more aligned with real economic earnings.

Unfortunately, the FASB knuckled under to this intense pressure by lobbyists for the financial institutions and a compromise was made that resulted in Investment Securities being divided into three categories.

First, Trading Investment Securities would be valued at fair value and any changes in their Unrealized Holding Gains and Losses would be recognized in the quarter when the Change in the Unrealized Holding Gains and Losses occurred.

Second, Investment Debt Securities Planned to be Held to Maturity would not be valued at fair value but instead go on the balance sheet at Cost or at Amortized Cost. Thus, there wouldn't be any quarterly Unrealized Holding Gains and Losses recorded.

And third, all other Investment Securities where fair values are available would be categorized as Available-For-Sale (AFS) Investment Securities and valued on the Balance Sheet at fair value. But the compromised very questionable and very strange twist was that any quarterly Change in the Unrealized Holding Real Economic Gains and Losses would not be reflected in the regular income statement but instead would be reflected in Other Comprehensive Income which unfortunately almost all financial analysts and even Company Board of Directors ignore.

The FASB was wrong when it just assumed financial investors would give the elements of Other Comprehensive Income their due real economic income respect.

Case in point ..... the fairly large SVB Financial Group that just recently filed for bankruptcy.

From its Investment Securities Footnote related to its December 2022 10-K filed with the US SEC, SVB Financial Group had Unrealized Holding Losses of $2.533 Bil related mostly to its US Treasury Securities and its Residential Mortgage-Backed Securities investment holdings.

To show how significant that $2.533 Bil Unrealized Holding Loss is to SVB Financial Group, its Regular Pretax Income in annual 2022 was a lower $2.172 Bil.

Also, at Dec 31, 2021, these Unrealized Holding Losses were only $313 Mil.

Clearly, US Fed Chair Jerome Powell's decision to substantially increase US Short-Term Interest Rates so rapidly and by so much was the predominant catalyst for US Banks substantial increase in their real Unrealized Economic Holding Losses of their AFS Investment Securities, which triggered the current US Banking Crisis.

SVB Financial Group's Loss Risks on its Available For Sale Investment Securities at Dec 31, 2022 were properly under US GAAP reported in Other Comprehensive Income and also disclosed in its footnotes.

But what good is that if financial analysts pretty much ignore each of these disclosures?

And the US Security and Exchange Commission does not require the key real Unrealized Economic Holding Gains and Losses amount be disclosed very prominently in Company Quarterly Earnings Releases. And when it is disclosed, it is buried in a very obscure place in the very lengthy Bank Quarterly Earnings Release.

Then shortly after 2022 year end, on March 8, 2023, SVB disclosed in another SEC filing that it was selling $21 bil of its Available-For-Sale Investment Securities with a 1.79% Interest Yield and a 3.6 Year Duration and that the resultant Realized After-Tax Loss was estimated at $1.8 Bil and it would be reflected in its First Quarter Regular 2023 Earnings.

Then the shit hit the fan and many cash depositors quickly withdrew their cash from SVB Financial Banks to the extent that they could.

Economically, these Unrealized Holding Losses occurred prior to December 31, 2022 but because they were included in Other Comprehensive Income rather than in Regular 2022 Earnings, the financial analysts short-sightedly weren't concerned much about it.

But shortly after December 31, 2022 when the Unrealized Losses were realized and thus be required to be recorded in First Quarter 2023 Regular Earnings, the start of the current banking crisis occurred and now a lot of people are investigating how much each US bank and even some non-financial companies have in real Unrealized Economic Holding Losses at December 31, 2022 and whether they are being wisely hedged and also trying to find out how much additional real Unrealized Economic Holding Losses each US Bank has so far in the First Quarter of 2023.

So it's not just the Bank Board of Directors, the Bank CEOs, the Bank CFOs, the Bank Company Risk Managers, the Financial Analysts of Banks, the US Government Bank Regulators, the US SEC, the US Senators, the US House Banking Committee Members and clearly most of all the US Fed Chair Jerome Powell who are all the predominant causes of this current Banking Crisis by acting incompetently.

But it's also the US FASB for not doing what was and is right ..... making financial disclosure useful to investors.

To Report Income-Smoothed Quarterly Earnings as being anything close to real Quarterly Economic Earnings breaks the back of successful US Capitalism.

Tuesday, February 28, 2023

The 50 Largest US Non-Dow 30 Industrials Cos Suffered an Extremely Sharp Downturn in Their Total US GAAP Quarterly Earnings From the Previous Year's Quarter That Started in the Second Quarter of 2022 (Down By a Massive 44%), Then Somewhat Improved But Still Down in the Third Quarter of 2022 (To Down By 15%), and Then Again Exploded Substantially Down in the Fourth Quarter of 2022 (To Down By 41%).

The 48 Largest US Non-Dow 30 Industrials Cos Which Were Not Oil & Gas Cos Suffered an Even More Severe Downturn in Their Total US GAAP Quarterly Earnings From the Previous Year's Quarter That Started in the Second Quarter of 2022 (Down By a Massive 56%), That Continued in the Third Quarter of 2022 (To Down By 27%), and Then Again Plummeted in the Fourth Quarter of 2022 (To Down By 46%).

Tuesday, February 21, 2023

The 50 Largest US Non-Dow 30 Industrials Cos Suffered a Sharp Downturn in Their Total Earnings From the Previous Year Period That Started in the Third Quarter of 2022 (Down By 17%) and Then Exploded Substantially Further Down in the Fourth Quarter of 2022 (Down By 37%). The Giant Berkshire Hathaway Hasn't Reported Its 4Q 2022 Earnings Yet, But When It Does This Weekend, That 37% Total Earnings Decline Should Probably Decline By More Given Apple's Outstanding Stock Market Price Performance in the 4Q of 2021 vs Its Down Performance in the 4Q 2022. Clearly, These 50 US Companies 4Q 2022 Total Earnings Disaster Should Be Put in the Earnings Depression Category Rather Than in the Earnings Recession Category.

From Companies 10-Qs and earnings releases filed with the US SEC, the table below shows the Gold-Standard US GAAP Earnings (Losses) From Continuing Operations for each of the 50 largest by very recent stock market capitalization US Non-Dow 30 Industrials Companies for the third and fourth quarters of both 2022 and 2021.

Wednesday, February 15, 2023

Tuesday, February 14, 2023

Coca-Cola's Worldwide Consolidated Higher Pricing/Mix Component of Its Organic Revenue Growth Was a Very High 12% in Its Fourth Quarter of 2022, Which Precisely Matched That in Its Third Quarter of 2022. But Even With This Steep Pricing Action, Its Bottom-Line Earnings Tumbled By 16% in Its Fourth Quarter of 2022 After Increasing By 14% in Its Third Quarter of 2022.

Thursday, February 9, 2023

PepsiCo's Worldwide Consolidated Higher Pricing Component of Its 15% Organic Revenue Growth Was 16% in Its Fourth Quarter of 2022, Which Was Slightly Lower Than Its 17% Higher Pricing Component in Its Third Quarter of 2022.

PepsiCo's Exceptionally Highly Profitable Frito-Lay North America Segment's Higher Pricing Component Was 18% in Its Fourth Quarter of 2022, Which Was Slightly Lower Than Its 20% Higher Pricing Component in Its Third Quarter of 2022.

PepsiCo's Large PepsiCo North America Segment's Higher Pricing Component Was 12% in Both Its Fourth and Third Quarters of 2022.

Tuesday, February 7, 2023

The Five Largest US Technology Cos Suffered a Total Earnings Decline of an Amazing 33% in Their Most Recently Reported Quarterly Earnings.

And the Seven Largest US Cos Suffered a Total Earnings Decline of an Even More Amazing 40% in Their Most Recently Reported Quarterly Earnings.

Saturday, February 4, 2023

Tesla Experienced Massive Revenues, Gross Profit And Operating Income Growth Deceleration From the Prior Year Quarters All Through the Annual Year 2022.

Tesla's Revenues Increased By 37% in the December 2022 Quarter vs Increasing By 56% in the September 2022 Quarter and vs Increasing By 81% in the March 2022 Quarter.

Tesla's Gross Profit Increased By Only 19% in the December 2022 Quarter vs Increasing By 47% in the September 2022 Quarter and vs Increasing By a Huge 147% in the March 2022 Quarter.

Tesla's Operating Income Increased By 49% in the December 2022 Quarter, But That Was Because Tesla Slashed Selling, General & Admin Expenses, Which Declined By 31% in the December 2022 Quarter. On the Other Hand, Tesla's Operating Income Increased By 84% in the September 2022 Quarter and Increased by a Massive 507% in the March 2022 Quarter.

Tesla December 2022 Earnings Release

Apple Experienced Huge Deceleration of Both Revenues and Operating Income Growth in Its December 2022 Quarter From Its December 2021 Quarter. Revenues Were Down By 5% in the December 2022 Quarter After Increasing By 8% in the September 2022 Quarter. And Operating Income Declined By 13% in the December 2022 Quarter After Increasing By 5% in the September 2022 Quarter.

And even though it has Total Annual Product Revenues of $316 Bil, Apple refused to disclose Its higher Sales Pricing/Mix % Component of its Total Product Revenues % change.

Apple December 2022 Quarter 10-Q

Thursday, February 2, 2023

JNJ Experienced Huge Adjusted Operational Sales Growth Deceleration With Only +0.8% in the 4Q of 2022, After +8.2% in 3Q of 2022, +8.1% in the 2Q of 2022 and of +7.9% in the 1Q of 2022. Adjusted Operational Sales Growth is the Same as Organic Sales Growth and Excludes the Impacts of Acquisitions, Divestitures, and Foreign Currency Changes. Unfortunately It Also Doesn't Break Out the Two Components of Adjusted Operational Sales Growth ..... Higher Sales Pricing and Sales Volume.

With such very recent huge Sales Growth Deceleration, I now better understand why JNJ is planning a split-up.

Also JNJ refuses to disclose its Higher Sales Pricing and Sales Volume Components of its Adjusted Operational Sales Growth. I wonder what % its Tylenol went up in price?

Wednesday, February 1, 2023

Leggett & Platt Bedding Product Trade Sales Increased By 16% in the First Nine Months of 2022 From the Prior Year Period Just Due to Higher Selling Prices.

Leggett & Platt Furniture, Flooring & Textile Product Trade Sales Increased By 12% in the First Nine Months of 2022 From the Prior Year Period Just Due to Higher Selling Prices.

Tuesday, January 31, 2023

Packaging Corp of America's Packaging Net Sales Increased By 14.1% in the First Nine Months of 2022 Just Due to Higher Sales Pricing and Mix.

Packaging Corp of America's Paper Net Sales Increased By 15.3% in the First Nine Months of 2022 Just Due to Higher Sales Pricing and Mix.

Monday, January 30, 2023

Sunday, January 29, 2023

United Parcel Service's US Domestic Packages Had a Higher Price Rates/Product Mix of 4.6% and Fuel Surcharges of an Additional 5.5% For a Total Pricing Increase of 10.1% For the First Nine Months of 2022 From the First Nine Months of 2021.

And United Parcel Service's International Packages Had a Higher Price Rates/Product Mix of 8.1% and Fuel Surcharges of an Additional 8.1% For a Total Pricing Increase of 16.2% For the First Nine Months of 2022 From the First Nine Months of 2021.

US Utility Sempra Energy's Southern California Gas Co's Average Cost of Natural Gas Sold Increased By 121% For the First Nine Months of 2022 From That in the Prior Nine-Month Period.

US Utility Sempra Energy's San Diego Gas & Electric Co's Average Cost of Natural Gas Sold Increased By 68% For the First Nine Months of 2022 From That in the Prior Nine-Month Period.

Sempra Energy September 2022 10-Q

Saturday, January 28, 2023

US Utility Co Southern Company Total Operating Revenues and Earnings Both Up a Blistering 34% in the September 2022 Quarter From the September 2021 Quarter.

Retail Electric Revenues increased by 31% in the September 2022 Quarter. Of that 31% increase, a huge 25.2% was due to Fuel and Other Cost Recovery, primarily Higher Fuel and Higher Purchased Power Costs. Another 3.6% of the 31% was due to Rates and Pricing.

Wholesale Electric Revenues increased by 64% in the September 2022 Quarter. Of that 64%, 60% was a result of Fuel and Purchased Power increases.

Natural Gas Revenues increased by 37.6% in the September 2022 Quarter. Of the 37.6%, 27.6% was a result of Fuel and Purchased Power increases.

Looking at September 2022 Quarter Total Expenses, Total Fuel expenses were an credible 96% higher and Total Purchased Power Expenses were an even more incredible 124% higher than that in the September 2021 Quarter.

Suffice it to say that Utility Customers cannot be happy with the incredibly high addons to their Utility bills for the higher fuel, for the higher purchased power and for the higher other cost recovery that are being passed on to them.

And there is something seriously wrong with US capitalism when a large Utility Company reports 34% earnings growth but gets there only by passing on a high percentage of its higher costs to its Utility customers.

Oil & Gas Co HF Sinclair's Huge Refining Segment Saw Its Gross Margin Per Barrel Sold Increase By a Blistering 112% in the September 2022 Quarter Due to Much Higher Crude Oil, Gasoline and Especially Diesel Prices, Coupled With Rapidly Expanding Market Crack Spreads, Which Led to an Earnings Increase of 223%

Friday, January 27, 2023

Thursday, January 26, 2023

Wednesday, January 25, 2023

Chicken Processor and Distributor Pilgrim's Pride US Segment's Net Sales Prices Per Pound Increased By 16% in the September 2022 Quarter From That in the Prior Year's Quarter.

And Pilgrim's Pride UK and Europe Segment's Net Sales Prices Per Pound Increased By 25% in the September 2022 Quarter From That in the Prior Year's Quarter.

Refining Co Valero Energy Saw Its September 2022 Quarter Refining Margins Increase By $3.2 Bil and More Than 100% of That Was Due to Substantially Higher Diesel Fuel Prices. The Increase in the Market Prices For Diesel Fuel in the Four US Regions in the Sept 2022 Quarter vs in the Year Ago Quarter Were Amazingly High: US Gulf Coast +247%, US Mid-Continent +212%, US North Atlantic +220% and US West Coast +178%.

Tuesday, January 24, 2023

Chevron's US Upstream Segment's Average Sales Prices For Its Crude Oil & Natural Gas Liquids Increased By 31% and Its Average Sales Prices For Its Natural Gas Increased By Another 117% in the Sept 2022 Quarter From the Prior Year Quarter.

Chevron's International Upstream Segment's Average Sales Prices For Its Crude Oil & Natural Gas Liquids Increased By 31% and Its Average Sales Prices For Its Natural Gas Increased By Another 65% in the Sept 2022 Quarter From the Prior Year Quarter.

Monday, January 23, 2023

Albemarle's Increased Pricing Benefits in the Sept 2022 Quarter Were $1.173 Bil or a Completely Off-the-Charts +141% of Sept 2021 Total Net Sales of $ 0.831 Bil

Albemarle's Increased Pricing Benefits for the Nine Months Ended Sept 2022 Were $2.071 Bil or a Completely Off-the-Charts +85% of the Nine Months Ended Sept 2021 Total Net Sales of $ 2.434 Bil

Sunday, January 22, 2023

Saturday, January 21, 2023

Corteva Had an Exceptionally High +13% Pricing Component of Its Net Sales % Change in Its Most Recent Sept 2022 Quarter That Was 13 Times Its +1% Higher Pricing That It Had in the Five-Quarters-Ago June 2021 Quarter

Corteva's CEO elected to raise its prices dramatically on its products in its most recent five quarters.

From its six most recent Quarterly Earnings Releases and its 10-Qs filed with the US SEC, here are the Higher Pricing Components of Net Sales % Changes for the most recent six quarters:

- Sept 22 Quarter +13% (Wow!)

- June 22 Quarter +9% (Wow!)

- March 22 Quarter +9% (Wow!)

- Dec 21 Quarter+8% (Wow!)

- Sept 21 Quarter +7% (Wow!)

- June 21 Quarter +1%

Friday, January 20, 2023

Union Pacific's Freight Revenue Just From Fuel Surcharges Increased By an Amazing 158% in the September 2022 Quarter From the Prior Year Quarter. This Increase Amounted to a 13.2% Pricing Increase From the September 2021 Quarter Total Operating Revenues and to a 14.2% Price Increase From the September 2021 Quarter Total Freight Revenues.

Thursday, January 19, 2023

Keurig DrPepper Had an Exceptionally High Pricing Component of Its Net Sales % Change in Its Two Most Recent Quarters ..... +12.1% in Its Sept 2022 Quarter and +10.4% in Its June 2022 Quarter

Keurig DrPepper's CEO elected to raise its prices dramatically on its products in its two most recent quarters.

From its five most recent Quarterly Earnings Releases filed with the US SEC, here are the Higher Pricing Components of Keurig DrPepper's Net Sales % Changes :

- Sept 22 +12.1% (Wow!)

- June 22 +10.4% (Wow!)

- March 22 +6.3%

- Dec 21 +4.1%

- Sept 21 +3.6%

French Luxury Goods Giant LVMH Louis Vuitton Reported US Region Organic Revenue Growth of +26% For the Sept 2022 Quarter, +22% For the June 2022 Quarter and +11% For the March 2022 Quarter. Europe Region Organic Revenue Growth Was +45% For the Sept 2022 Quarter, +48% For the June 2022 Quarter and +36% For the March 2022 Quarter.

Organic Revenue growth eliminates foreign currency effects. In substance, there are two elements to organic growth ..... price increases and volume changes.

LVHM did not report its pricing and volume elements for its 2022 quarters. The only mention of pricing increases was that it said that it had a very firm price increase policy in its Wine & Spirits segment.

Given how huge LVMH's organic Revenue growth was in both its US Region and especially so in its Europe Region in both the second and third quarters of 2022, any reasonable breakdown of this organic growth between Price Increases and Volume impacts should yield double-digits % increases for pricing in both the US Region and especially so in the Europe Region for both the second and third quarters of 2022.

LVMH Louis Vuitton Third Quarter 2022 Revenue

Wednesday, January 18, 2023

Paccar's Increase in Its Truck Net Sales and Revenues Due Just to Higher Average Truck Sales Prices Was an Extremely High +14.9% in the Most Recent Sept 2022 Quarter That Was 3.73 Times That in the Year-Ago Sept 2021 Quarter of Only +4.0%

Paccar's truck customers cannot be happy with Paccar's exceptionally high pricing increases on its trucks in 2022.

Tuesday, January 17, 2023

Honeywell Had an Exceptionally High +11% Higher Pricing Component of Its Net Sales % Change in Its Most Recent Sept 2022 Quarter That Was 2.75 Times of That in Its Year-Ago Sept 2021 Quarter of 4%

Honeywell's CEO elected to raise its prices dramatically on its products in its three most recent quarters.

From its most recent Quarterly 10-Q's filed with the US SEC, here are the Pricing Components of Honeywell's Net Sales % Changes :

- Sept 22 +11% (Wow!)

- June 22 +9% (Wow!)

- March 22 +7% (Wow!)

- Dec 21 Not Disclosed

- Sept 21 +4%

Saturday, January 14, 2023

Lamb-Weston Had Outrageously High 30% Price/Mix Component of Its Net Sales Increase in Its Most Recent Nov 22 Quarter, After Exceptionally High Price/Mixes of 19% in Its Aug 22 Quarter and of 14% in Its May 22 Quarter.

Lamb-Weston's CEO elected to raise its prices by an almost unbelievable % on its products in its three most recent quarters.

Lamb-Weston November 2022 Press Release

Friday, January 13, 2023

JM Smucker & Co Had Exceptionally High Price Inflation in Each of Its Most Recent Three Quarters ..... +17% in Its Oct 22 Quarter, +14% in Its July 22 Quarter and +10% in Its April 22 Quarter.

JM Smucker & Co dramatically raised its prices on its products in its three most recent quarters.

JM Smucker & Co Oct 2022 Earnings Release

Kellogg Had an Extremely High 15.7% Pricing/Mix (Predominately Higher Pricing Inflation) Component of Its Net Sales % Increase in its Most Recent Sept 2022 Quarter, 3.65 Times That in its Year-Ago Sept 2021 Quarter of 4.3%.

From its most recent five Quarterly Earnings Releases filed with the US SEC, here are the Price/Mix (Predominately Higher Pricing Inflation) Components of Kellogg's Net Sales % Increases for the most recent five quarters:

- Sept 22 +15.7% (Wow!)

- June 22 +13.7% (Wow!)

- March 22 +9.9% (Wow!)

- Dec 21 +8.8% (Wow!)

- Sept 21 +4.3%

Clearly, Kellogg's Pricing Inflation was outrageous in all of 2022.

Its customers cannot be happy with Kellogg's exceptionally high pricing increases of its products all throughout 2022.

General Mills Had an Exceptionally High 17% Price and Mix (Predominately Pricing Inflation) Component of Its Net Sales % Increase in Both of Its Two Most Recent Quarters (Nov 22 and Aug 22) That Was 5.7 Times That in Its Aug 21 Quarter of 3%.

From its most recent Quarterly Earnings Releases and 10Qs filed with the US SEC, here are the Price and Mix (Predominately Higher Pricing Inflation) Components of General Mills' Net Sales % Increases for the most recent six quarters:

- Nov 22 +17% (Wow!)

- Aug 22 +17% (Wow!)

- May 22 +14% (Wow!)

- Feb 22 +11% (Wow!)

- Nov 21 +7%

- Aug 21 +3%

Clearly, General Mills' Pricing Inflation was outrageous in all of 2022.

Its customers cannot be happy with General Mills' exceptionally high pricing increases of its products all throughout 2022.

General Mills November 2022 10Q

Thursday, January 12, 2023

W. W. Grainger's Large High-Touch Solutions NA Segment's Pricing Inflation Was 12.1% in Its Most Recent Sept 2022 Quarter, Four Times That of Its Year-Ago Sept 2021 Quarter's Pricing Inflation of 3.0%.

Clearly, W. W. Grainger's Largest Segment's most recent Quarterly Pricing Inflation is extremely high.

Its customers cannot be happy with these extremely high pricing increases on its products.

Ferguson plc Had Its Pricing Inflation on Its Net Sales Spike Up to 15% in Its Most Recent Oct 2022 Quarter, After Averaging Pricing Inflation of 3% in Its Fiscal Year Ended July 2022.

Clearly, Ferguson's most recent Pricing Component of Its Net Sales Increase is abnormally high.

Its customers cannot be happy with Ferguson's outlandishly high pricing increases on its products.

Campbell Soup Had an Extremely High 16% Prices and Sales Allowances (Higher Pricing Inflation) Component of Its Net Sales % Increase in its Most Recent Oct 2022 Quarter, 4 Times That in its Year-Ago Oct 2021 Quarter (4%) and 16 Times That in its July 2021 Quarter (1%) Only Five Quarters Ago.

From its most recent six Quarterly Earnings Releases filed with the US SEC, here are the Prices and Sales Allowances (Higher Pricing Inflation) Components of Campbell Soup's Net Sales % Increases:

- Oct 22 +16%

- July 22 +14%

- April 22 +11%

- Jan 22 +5%

- Oct 21 +4%

- July 21 +1%

Clearly, Campbell Soup's recent Pricing Component of Its Net Sales % Increase is abnormally high recently.

Its customers cannot be happy with Campbell Soup's extremely high pricing increase of its products in its most recent three quarters.

Wednesday, January 11, 2023

Coca-Cola North America Had an Extremely High 15% Price/Mix Component (Predominately Higher Pricing) of Its Net Operating Revenues % Increase in the Most Recent Sept 2022 Quarter, 1.5 Times That in the June 2022 Quarter (10%) and Triple That in the Year-Ago Sept 2021 Quarter (5%).

From its most recent five Quarterly Earnings Releases filed with the US SEC, here are the Price/Mix Components of Coca-Cola's North America Segment's Net Operating Revenues % Increases:

- Sept 2022 +15%

- June 2022 +10%

- March 2022 +11%

- Dec 2021 +9%

- Sept 2021 +5%

Clearly, Coca-Cola North America's recent Pricing Component of Its Net Operating Revenues % Increase is abnormally high.

Its US customers cannot be happy with Coca-Cola North America's extremely high pricing increase of its products in the most recent Sept 2022 quarter.

Conagra Brands Had an Extremely High 17.0% Price/Mix Component (Predominately Higher Pricing) of Its Net Sales Increase in the Most Recent November 2022 Quarter, More Than 10 Times Its Modest 1.6% Price/Mix Component in the Aug 2021 Quarter Only Five Quarters Ago

From its most recent six Quarterly Earnings Releases filed with the US SEC, here are the Higher Price/Mix Components of Conagra Brands' Total Net Sales % Increases:

- Nov 2022 +17.0%

- Aug 2022 +14.3%

- May 2022 +13.2%

- Feb 2022 +8.6%

- Nov 2021 +6.8%

- Aug 2021 +1.6%

Clearly, Conagra Brands' recent Pricing Components of Its Net Sales Increases are abnormally high.

Its customers cannot be happy with Conagra Brands' outlandishly high pricing increases of its products.

Deere & Co Had 11.3% Higher Price Realization (Inflation) in Its Most Recent Fiscal Year Ended (FYE) Oct 2022 That Was 85% Higher Than the 6.1% Higher Price Realization in its Prior FYE Oct 2021. Also, in Its Most Recent Oct 2022 Quarter, Its Higher Price Realization Spiked Up to 15.4%.

Clearly, Deere & Co's recent Pricing Component of Its Net Sales Increase is abnormally high.

Its customers cannot be happy with Deere's outlandishly high pricing increases of its products.

Deere October 2022 Quarter Earnings Release

Tuesday, January 10, 2023

Caterpillar Had Very High 13.2% Favorable Price Realization (Inflation) in Its Most Recent Sept 2022 Quarter Which Was Five Times Its Modest 2.4% Favorable Price Realization One Year Earlier in Its Sept 2021 Quarter.

From its most recent five Quarterly Earnings Releases filed with the US SEC, here are the Higher Favorable Price Realization (Inflation) Components of Caterpillar's Worldwide Consolidated Total Sales and Revenues % Increases:

- Sept 2022 +13.2%

- June 2022 +8.6%

- March 2022 +5.9%

- Dec 2021 +4.5%

- Sept 2021 +2.6%

Monday, January 9, 2023

Worldwide Consolidated Kimberly-Clark Had Very High Pricing (Inflation) Components in Each of the Most Recent Three Quarters ... +9% in Both the Sept 22 and June 22 Quarters and +6% in the March 22 Quarter That Was Substantially Above That in the Previous Three Quarters, Which Averaged a Modest 2% Per Quarter.

From its most recent six Quarterly Earnings Releases filed with the US SEC, here are the Higher Pricing (Inflation) Components of Worldwide Consolidated Kimberly-Clark's Net Sales Increases:

- Sept 2022 +9%

- June 2022 +9%

- March 2022 +6%

- Dec 2021 +2%

- Sept 2021 +3%

- June 2021 +1%

- Sept 2022 +8%

- June 2022 +9%

- March 2022 +8%

- Dec 2021 +4%

- Sept 2021 +4%

- June 2021 0%

- Sept 2022 +9%

- June 2022 +7%

- March 2022 +5%

- Dec 2021 (-1%)

- Sept 2021 +1%

- June 2021 0%