During the 4 Years of the Trump Admin, These US Cos Experienced a Total Audited Annual Earnings Decline of $123 Bil or of 12%.

And During the 8 Years of the Obama Admin, These US Cos Reported Total Audited Annual Earnings Improvement of a Massive $1.02 Trillion or of 2,794% (An Average Annual Increase of a Spectacular 349% Per Year). And This Was Accomplished in an 8 Year Period Where US Inflation Averaged Below 2% Per Year. This Occurred Because Wise, Very Targeted, Moderate ($2 Trillion in Total) Stimulation of the US Economy Was Taken By the Obama Admin and By the US Fed Chair Ben Bernanke.

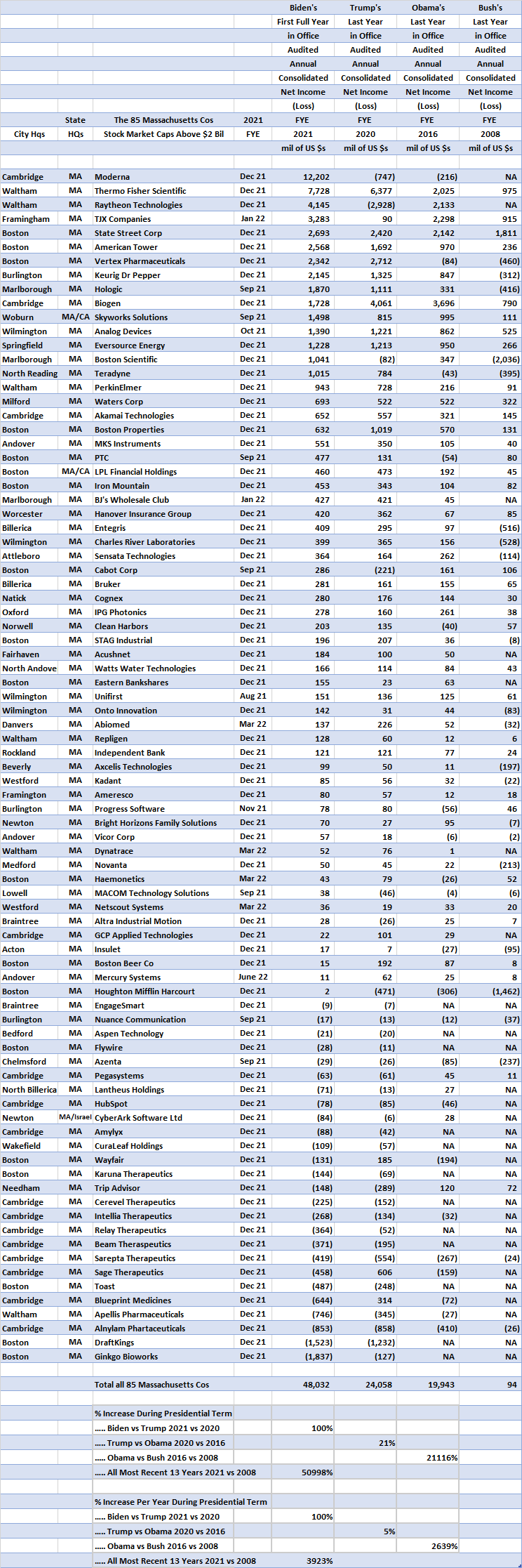

From a review of primarily the companiesmarketcap.com, but also of valuetoday.com, of the Google Finance website, of the investing.com website, of the yahoo finance website and of Company SEC filings, there were 1,666 in-substance US Companies with stock markets caps above $2 bil several weeks ago. Included in these 1,666 US Companies are ones that were acquired for more than $2 bil and that also filed their fiscal year end 2021 financial statements with the SEC.

And from Company financial statements contained in the SEC website, the table below shows the Audited Gold-Standard US GAAP Consolidated Net Income (Loss) from Continuing Operations for each of these largest 1,666 US Companies for 2021, the Biden Administration's first year in office, for 2020, the Trump Administration's last year in office, for 2016, the Obama Administration's last year in office and for 2008, the Bush Administration's last year in office.

There are a handful of these 1,666 US Companies that had very significant company separations which made their reported 2008 earnings amounts not meaningful in comparison to their more recent years' earnings amounts and thus their reported 2008 earnings are excluded from the below table.