From iBanknet, the table below shows the Audited Smoothed Net Income in annual 2022 and also the huge Estimated Economic Losses from the annual 2022 decline in the Fair Market Values of both their Available-For-Sale and their Held-to-Maturity Debt Investment Securities of each of the 10 largest in Total Assets US Credit Unions.

Wednesday, October 25, 2023

The 10 Largest US Credit Unions Posted Total Smoothed Net Income of $4,391 Mil in Annual 2022. But Not Included in 2022 Net Income Was Their Estimated Total Economic Losses of a Massive $8,760 Mil From the Annual 2022 Decline in the Fair Market Value of Their Available-For-Sale Debt Investment Securities. In Addition, Also Not Included in 2022 Net Income Was Their Estimated Total Economic Losses of $1,193 Mil From the Annual 2022 Decline in the Fair Market Value of Their Held-to-Maturity Debt Investment Securities.

The Big Four US Banks Posted Total Smoothed Net Income of $92.9 Bil in Annual 2022. But Not Included in 2022 Net Income Was Their After-Tax Economic Losses of $33.7 Bil From the Annual 2022 Decline in the Fair Market Value of Their Available-For-Sale Debt Investment Securities. But Much More Importantly, Also Not Included in 2022 Net Income Was Their Pre-tax Economic Losses of a Massive $201.7 Bil From the Annual 2022 Decline in the Fair Market Value of Their Held-to-Maturity Debt Investment Securities.

From their SEC filings, the table below shows the Audited Smoothed Net Income in annual 2022 and also their huge Economic Losses from the annual 2022 decline in the Fair Market Values of both their Available-For-Sale and their Held-to-Maturity Debt Investment Securities of each of what are considered to be the Big Four US Banks ..... JPMorgan Chase, Bank of America, Wells Fargo and Citigroup.

Tuesday, October 24, 2023

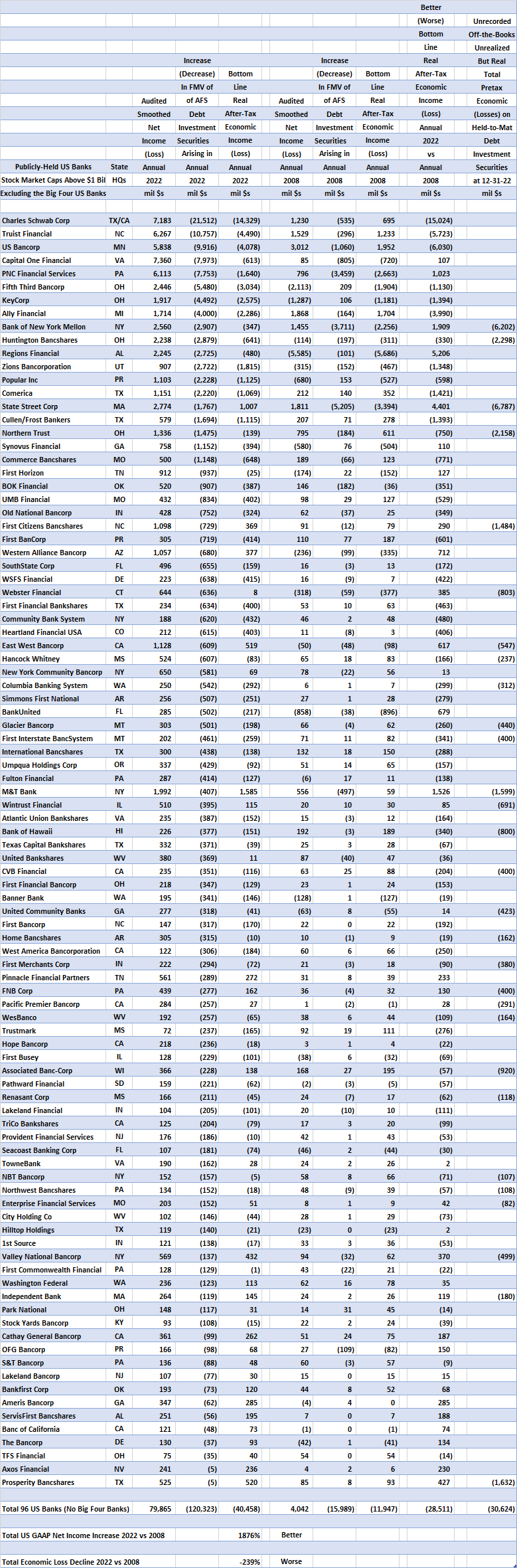

The 96 US Banks, Excluding the Big Four Banks, With Stock Market Caps Above $1 Bil Posted Total US GAAP Net Income of $79.865 Bil in Annual 2022, Up 1876% From Such Income of $4.042 Bil in the US Financial Meltdown Year of 2008. But These Same 96 US Banks Reported Total Bottom Line Economic Losses of $40.458 Bil in Annual 2022, 239% Worse Than Such Losses of $11.947 Bil in 2008. Why Such an Incredible Divergence? Well, Predominately It Was That In Annual 2022, These 96 Banks Reported a Massive $120 Bil of Economic Losses Which Bypassed US GAAP Net Losses and Instead Were Buried in Annual 2022 Other Comprehensive Losses. These $120 Bil of Economic Losses Resulted From the Annual 2022 Decline in the Market Value of Their Available-For-Sale Debt Investment Securities, Due Predominately to the US Fed's Spastic Interest Rate Increases.

The 96 publicly-held US Banks with Stock Market Caps above $1 Bil and that disclosed its Financial Statements in both annual 2022 and in annual 2008 in its SEC filings reported Total Economic Losses of $11.947 Bil in annual 2008, the worst year for earnings for US Banks during the horrific 2008-2009 US Financial Meltdown.

So what happened in annual 2022?

Well, unfortunately these 96 US Banks posted Total Economic Losses of $40.458 Bil, predominately due to the US Fed's spastic interest rate actions which caused US Banks' Heavy Investments in Debt Securities to decline precipitously in value by $120 Bil just for their Available-For-Sale Debt Investment Securities in annual 2022.

In addition, 29 of these 96 Banks had material Unrecorded, Off-the-Books, Unrealized But Real Pretax Total Economic Losses of an additional $30.6 Bil at December 31, 2022 related to their Held-to-Maturity Debt Investment Securities.

From SEC filings, the table below shows this financial information for each of these 96 publicly-held US Banks.

Monday, October 23, 2023

The 34 Smaller US Banks With Stock Market Caps Between $1 Bil and $2 Bil Posted Total Bottom Line Economic Losses of $235 Mil in the US Financial Meltdown Year of 2008. But in Annual 2022, These Same 34 Banks Posted Total Economic Losses of $1.778 Bil, an Incredible 657% Decline From That in Annual 2008. On the Other Hand, These 34 US Banks Posted Total US GAAP Net Income in Annual 2022 That Increased By an Off-the-Charts 4,192% From That in Annual 2008. Why Such an Incredible Divergence? Well, In Annual 2022, These 34 Banks Reported $7.1 Bil of Economic Losses Which Bypassed US GAAP Net Income and Instead Were Buried in 2022 Other Comprehensive Losses. These $7.1 Bil of Economic Losses Resulted From the Annual 2022 Decline in the Market Value of Their Available-For-Sale Debt Investment Securities, Due Predominately to the US Fed's Spastic Interest Rate Increases.

The 34 smaller US Banks with Stock Market Caps between $1 Bil and $2 Bil and that disclosed its Financial Statements in both annual 2022 and in annual 2008 in its SEC filings reported Total Economic Losses of $235 Mil in annual 2008, the worst year for earnings for US Banks during the horrific 2008-2009 US Financial Meltdown.

So what happened in annual 2022?

Well, unfortunately these 34 smaller US Banks posted Total Economic Losses of $1.778 Bil, predominately due to the US Fed's spastic interest rate actions which caused US Banks' Heavy Investments in Debt Securities to decline precipitously in value in annual 2022.

In addition, 7 of these 34 Banks had material Unrecorded, Off-the-Books, Unrealized But Real Pretax Total Economic Losses of an additional $1.758 Bil at December 31, 2022 related to their Held-to-Maturity Debt Investment Securities.

From SEC filings, the table below shows this financial information for each of these 34 smaller US Banks.

Friday, October 20, 2023

The 37 US and Puerto Rico Banks With Stock Market Caps Between $2 and $5 Bil Posted Total Bottom Line Economic Income of $303 Mil in the US Financial Meltdown Year of 2008. But in Annual 2022, These Same 37 Banks Posted Total Economic Losses of $3.026 Bil, an Incredible 1,099% Decline From That in Annual 2008.

The 37 US and Puerto Rico Banks with Stock Market Caps between $2 and $5 Bil and that disclosed Financial Statements in both 2022 and in 2008 reported Total Economic Income of $303 Mil in annual 2008, by far the worst year for earnings for US Banks during the 2008-2009 horrific US Financial Meltdown.

So what happened in annual 2022?

Well, unfortunately these 37 US and Puerto Rico Banks posted Total Economic Losses of $3.026 Bil, predominately due to the US Fed's spastic interest rate actions which caused US Banks' Heavy Investments in Debt Securities to decline precipitously in value in annual 2022.

In addition, 14 of these 37 Banks had material Unrecorded, Off-the-Books, Unrealized But Real Pretax Total Economic Losses of an additional $6.687 Bil at December 31, 2022 related to their Held-to-Maturity Debt Investment Securities.

From SEC filings, the table below shows this financial information for each of these 37 smaller US and Puerto Rico Banks.

Tuesday, October 17, 2023

The 12 US Banks With Stock Market Caps Between $5 and $10 Bil Posted Total Bottom Line Economic Income of $290 Mil in the US Financial Meltdown Year of 2008. But in Annual 2022, These Same 12 US Banks Posted Total Economic Losses of $8.824 Bil, a Staggering 3,143% Decline From That in Annual 2008.

The 12 US Mid-Sized Banks with Stock Market Caps between $5 and $10 Bil had Total Economic Income of $290 Mil in annual 2008, by far the worst year for earnings for US Banks during the 2008-2009 horrific US Financial Meltdown.

So what happened in annual 2022?

Well, unfortunately these 12 US Banks posted Total Economic Losses of $8.824 Bil, predominately due to the US Fed's spastic interest rate actions which caused US Banks' Heavy Investments in Debt Securities to decline precipitously in value in annual 2022.

From SEC filings, the table below shows this financial information for each of these 12 mid-sized US Banks.

Sunday, October 15, 2023

Isolating Out the Big Four US Banks, the Other 13 US Banks With Stock Market Caps Above $10 Bil posted Total Bottom Line Economic Losses of $12.3 Bil in the US Meltdown Year of 2008, But Guess What? These Total Economic Losses More Than Doubled to $26.8 Bil in Annual 2022.

Excluding the Big Four US Banks (JPMorgan Chase, Bank of America, Wells Fargo and Citigroup), the other 13 US Banks with Stock Market Caps above $10 Bil and that reported both annual 2022 and annual 2008 financial statements with the SEC incredibly saw their Total Economic Losses more than double, going from annual 2008's $12.305 Bil, the worst year for US Financial Companies during the horrific 2008-2009 US Financial Meltdown, to the US Fed-driven annual 2022's $26.830 Bil Total Economic Losses.

In addition, 6 of these 13 US Banks had material Unrecorded, Off-the-Books, Unrealized But Real Pretax Total Economic Losses of an additional $20.5 Bil at December 31, 2022 related to their Held-to-Maturity Debt Investment Securities.

From SEC filings, the table below shows this financial information for each of these 13 large US Banks.

Friday, October 13, 2023

PNC Financial Services Group's Annual 2022 Bottom-Line Net Economic Losses Were $1.640 Bil, $1,023 Better Than Its Annual 2008 Such Economic Losses of $2.663 Bil.

U. S. Bancorp's Annual 2022 Bottom-Line Net Economic Losses Were $4.078 Bil, $6.030 Worse Than Its Annual 2008 Economic Income of $1.952 Bil.

Next I will address a comparison of the Bottom-Line After-Tax Net Economic Income or Losses in annual 2022 to that in annual 2008 for the publicly-held US Regional Banks.

PepsiCo's Very High Price Increases Continue in the Third Quarter of 2023

PepsiCo just announced its Third Quarter 2023 Worldwide Pretax Income, which increased by 22% from the third quarter 2022.

US Government Bonds Declined In Value By Nearly 25% From the Summer of 2020 To Early in the Past Week

US Government Bonds have now declined in value by nearly 25% since the summer of 2020 ..... their steepest decline in US history.