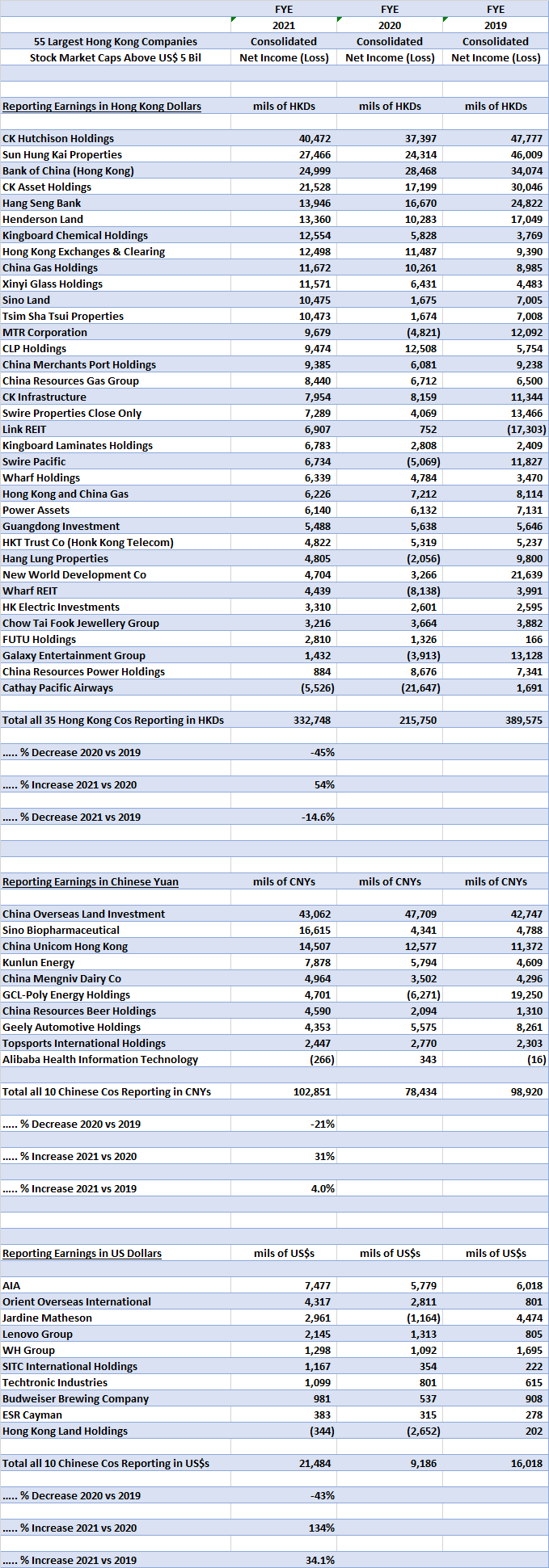

From the companiesmarketcap.com, the value.today, the investing.com and the google finance websites, I identified 55 Companies headquartered in Hong Kong with stock market caps above US$ 5 bil recently.

From a review of the investing.com website, the first table below shows the Consolidated Net Income (Loss) from Continuing Operations for fiscal years 2021, 2020 and 2019 for each of the 35 Hong Kong Companies reporting their earnings in Hong Kong dollars.

Also, from a review of the investing.com website, the second table below shows the Consolidated Net Income (Loss) from Continuing Operations for fiscal years 2021, 2020 and 2019 for each of the 10 Hong Kong Companies reporting their earnings in Chinese yuan.

And from a review of the investing.com website, the third table below shows the Consolidated Net Income (Loss) from Continuing Operations for fiscal years 2021, 2020 and 2019 for each of the 10 Hong Kong Companies reporting their earnings in US dollars.